Short Put Calendar Spread

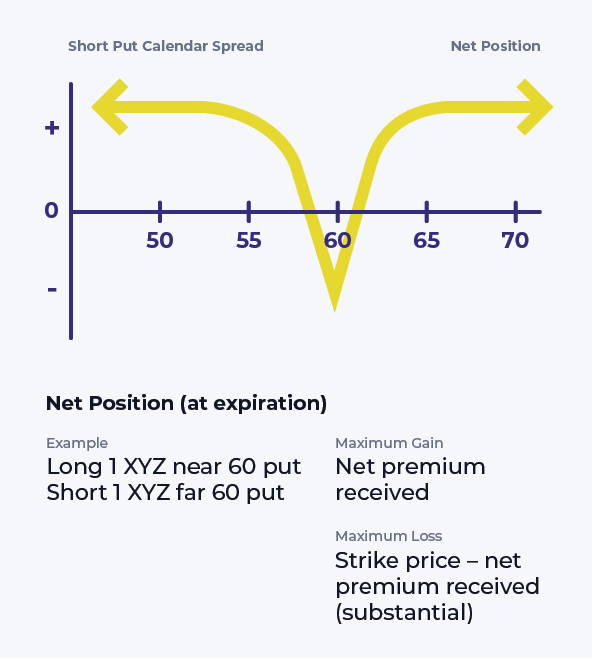

Short Put Calendar Spread - Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. With a short put calendar spread, the two. Web a short put calendar spread is another type of spread that uses two different put options. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a long calendar spread—often referred to.

Calendar Put Spread Options Edge

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option.

Advanced options strategies (Level 3) Robinhood

Web a short put calendar spread is another type of spread that uses two different put options. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a long calendar spread—often referred to as a time spread—is the buying and selling.

Short Calendar Put Spread Staci Elladine

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. With a short put calendar spread,.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put calendar spread is another type of spread that uses two different put options. With a short put calendar spread, the two. Web buying one put option and selling a second put option with a more.

Short Put Calendar Spread Options Strategy

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Entering into a calendar spread simply involves buying a call or put option for.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put.

Futures Calendar Spread Trading Strategies Gizela Miriam

With a short put calendar spread, the two. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. Entering.

Short Calendar Spread Option Strategy Dasie Emmalyn

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. With a short put calendar spread, the two. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option.

Web Buying One Put Option And Selling A Second Put Option With A More Distant Expiration Is An Example Of A Short Put Calendar Spread.

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities.

With A Short Put Calendar Spread, The Two.

Web a short put calendar spread is another type of spread that uses two different put options.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)